Pension and 401k retirement calculator

How Our Retirement Calculator Predicts Your Savings. The Vanguard Retirement Nest Egg calculator is designed to tell you the odds of your nest egg lasting in.

Early Retirement The Western Conference Of Teamsters Pension Trust

AARPs suite of web-based money tools will help you keep track of your finances and plan for events such as retirement.

. 401K and other retirement plans. This simple 401k savings calculator estimates your retirement investment growth and explains why. Spending a few minutes contemplating the results of this calculator can lead you to make an educated decision resulting in thousands more saved at retirement.

401k A tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. Explore Pension Corporation of Americas personalized approach to 401k management and retirement planning. Traditionally employee pensions are funds that employers contribute to as a benefit for their employees.

Upon retirement money can be drawn from a pension pot or sold to an insurance company to be distributed as periodic payments until death a life annuity. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Investment Methodology.

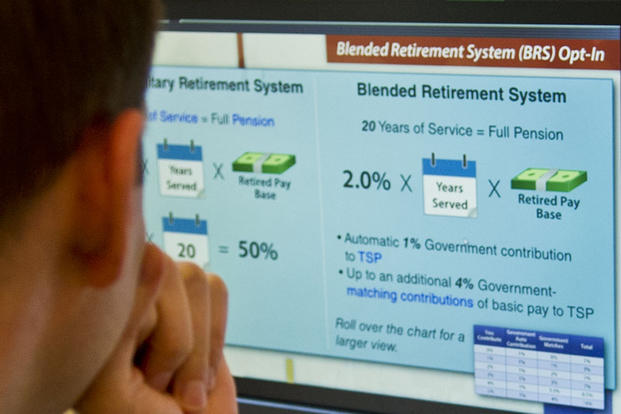

DCPs or to do calculations involving pension plans please visit the Pension Calculator. 401k Plan Fees Disclosure Tool A form developed by banking insurance and mutual fund trade groups to provide employers with a way to collect and compare investment fees and administrative costs of competing providers of plan services. The Thrift Savings Plan TSP was created by Congress in 1986 and is a tax-deferred retirement savings plan for federal employees.

Social Security The majority of Americans 65 years of age and over 84 to be exact receive monthly benefits via the Social Security Old Age. PCA is a national 401k provider uniquely positioned to provide customized retirement strategies with individual attention to companies individuals and financial professionals. See How It Works.

Pension Analyst for Employers. At the time of retirement this will provide a pre-tax income of which may increase at the rate of inflation throughout retirement. By the time Tim retires hell have 698314 in his retirement account.

And the contribution limit is pretty low 6000 a year7000 if youre 50 or older when you compare it to the 401k limit 20500 a year27000 if youre 50 or older. Use our free pension calculator to estimate your annual and monthly benefit. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

This simple 401k savings calculator estimates your retirement investment growth and explains why. If youre lucky enough to be deciding between these two retirement options. A pension guarantees you retirement income while a 401k plan depends on your own contributions and investments.

As a general rule if you withdraw funds before age 59 ½ youll trigger an IRS tax penalty of 10. To get this she has to contribute 675k4500yr for the next 4 years or 18k. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Similar to a 401k plan in the private sector the TSP allows employees to contribute a set dollar amount to the account every month. Our retirement savings calculator predicts your total retirement savings in todays amount then highlights how that amount might expand over the years you plan to spend in retirement with inflation taken into consideration. And if youre 50 or older you can.

You can put in up to 6000 a year. Other 401k calculators require a lot of deceptive detail. Use our pension calculator to see if you are on track to meet your.

Find out how to calculate your 401k penalty if you plan to access funds early. How much you receive in retirement from your pension depends on a number of factors. For those who do retire with a pension plan the median annual pension benefit is 9262 for a private pension 22172 for a federal government pension and 24592 for a railroad pension.

If you plan on retiring early however youll need a lot of money. Our default assumptions include. Early Withdrawal Calculator Terms Definitions.

But is it actually a good alternative to a 401k or other investment option. The AARP Retirement Calculator will help you decide. Consolidate your retirement savings by rolling your old 401k over into one convenient easy-to-monitor account.

An individual retirement account is one of the most popular ways to save for retirement given its large tax advantages. Employer-sponsored tax-deferred retirement plans like 401ks and 403bs have rules about when you can access your funds. The final tool is the easiest to use.

Rolling over assets from your old employers plan into a TD Ameritrade IRA can help you better manage your portfolio and can provide access to a broad range of investments while. This form was not developed by the Department and was not designed to ensure compliance with the Departments regulations on. Our Rollover IRA process is fast and hassle-free.

We arrived at as your desired pre-tax retirement income because you indicated you wanted a post-tax income of 50000 adjusted at a 2 rate of inflation for when you retire at years old. Find out when and how to retire the way. This amount automatically increases as the employees paycheck does.

Early withdrawals from a 401k retirement plan are taxed by the IRS. How are the Solo 401k contribution limits calculated. Powered by Pension Online.

Defined-contribution pension account as defined in subsection 401. Without taking any discounting or inflation into account it looks like a neat way to 10x a years 401k contribution limit. The tools in the suite will help you estimate your Social Security benefits figure out when your mortgage will be paid off and plan for retirement.

Related 401K Calculator Roth IRA Calculator Retirement Calculator Pensions. Use Prudentials retirement calculator to estimate what youll need to afford the lifestyle you want in retirement. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

The 2022 Solo 401k contribution limits are 61000 and 67500 if age 50 or older 2021 limits are 58000 and 64500 if age 50 or older. Use the solo 401k retirement calculator to calculate the maximum annual retirement contribution limit based on your income. Vanguard Retirement Nest Egg Calculator.

In most cases you cant tap tax-deferred retirement plans without a 10 percent penalty until the year you turn. But still the Roth IRA is your best bet if you dont have access to 401k or even if youre employer doesnt offer a 401k match. When should I retire.

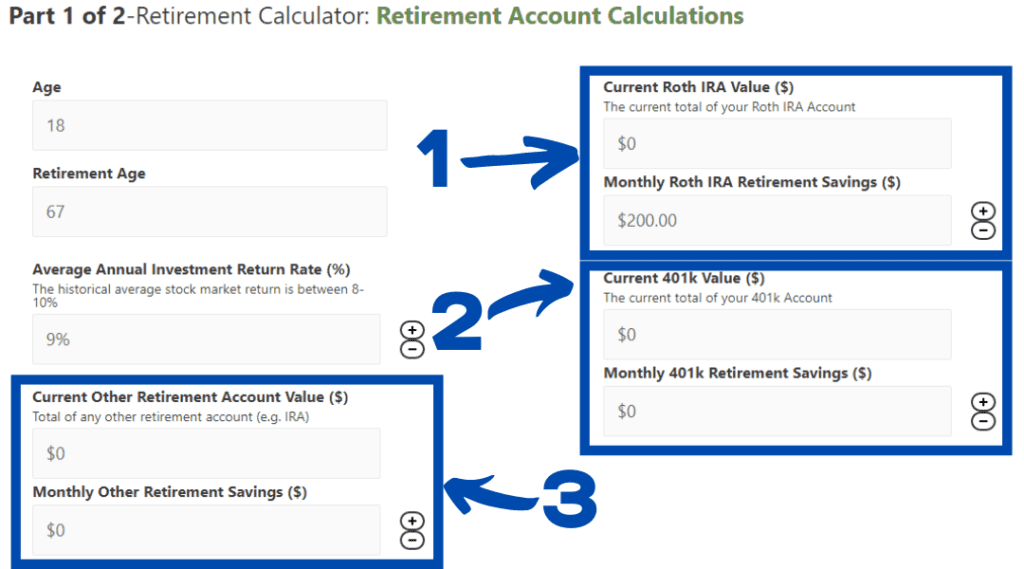

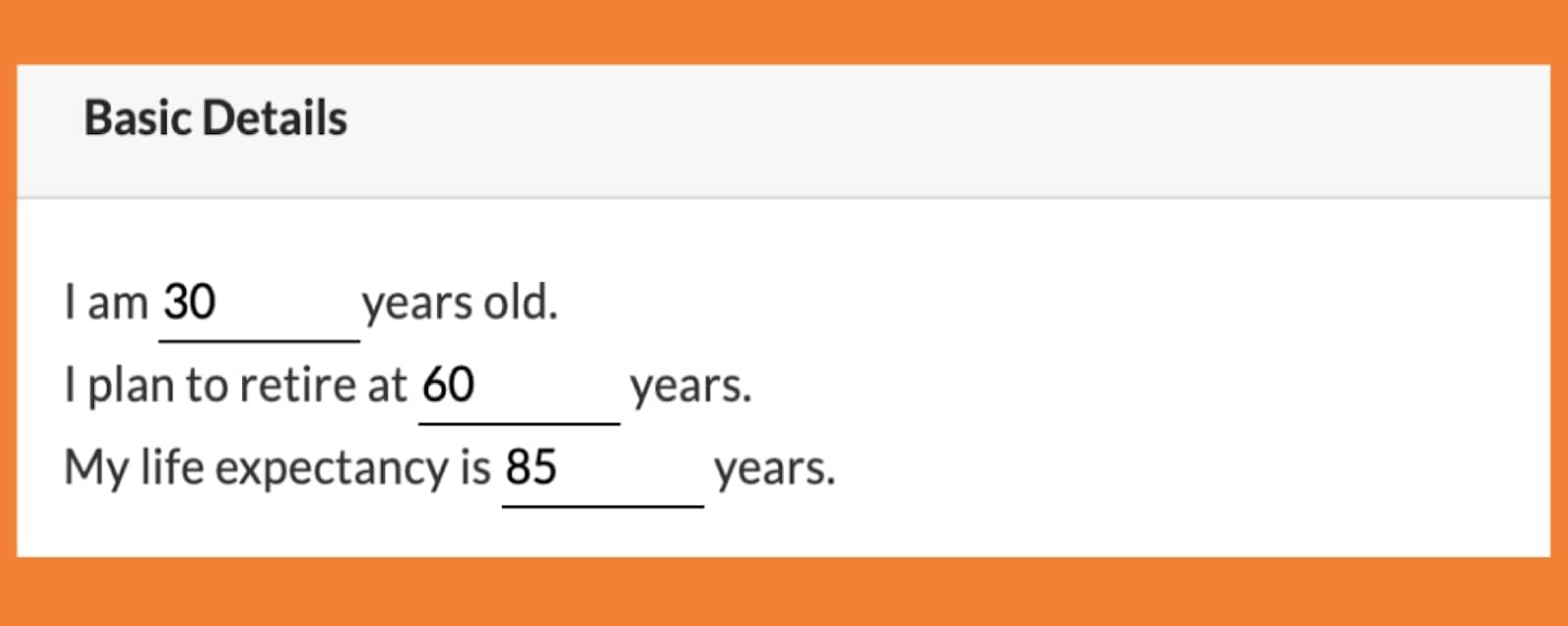

Retirement Planning Tool Visual Calculator

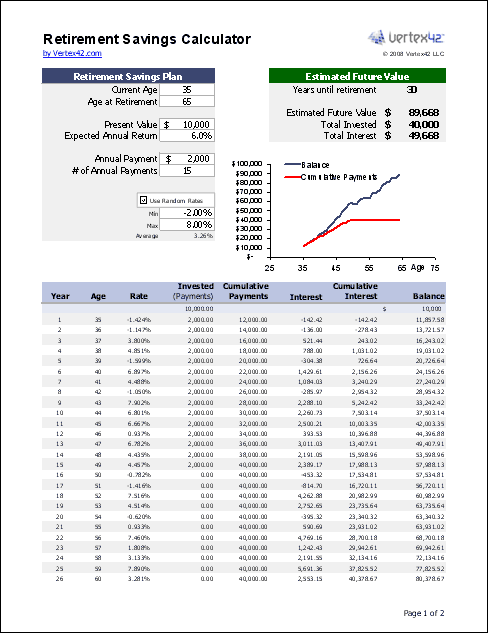

Free 401k Calculator For Excel Calculate Your 401k Savings

The 10 Best Retirement Calculators Newretirement

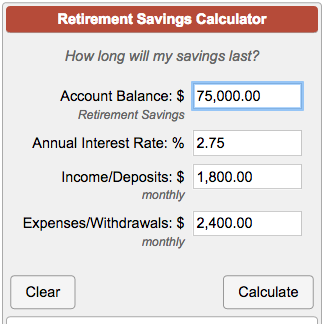

Retirement Withdrawal Calculator For Excel

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Retirement Calculator With Social Security 401k Roth Ira Start Planning Retirement Now Yp Investors

Retirement Calculator With Pension Cheap Sale 59 Off Www Ingeniovirtual Com

Pension Vs 401 K Key Differences Similarities

Download 401k Calculator Excel Template Exceldatapro

The 10 Best Retirement Calculators Newretirement

Retirement Calculator With Pension Cheap Sale 59 Off Www Ingeniovirtual Com

Normal Retirement The Western Conference Of Teamsters Pension Trust

The 10 Best Retirement Calculators Newretirement

Retirement Calculator With Pension Cheap Sale 59 Off Www Ingeniovirtual Com

The Blended Retirement System Explained Military Com

Retirement Growth Calculator Best Sale 57 Off Www Ingeniovirtual Com

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock